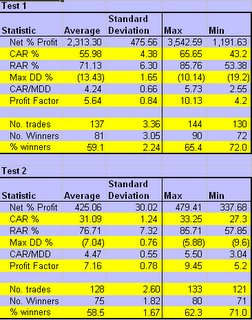

I combined 2 systems together and simulated trading using the same position sizing and capital bases for both systems from 1999 to 2006.

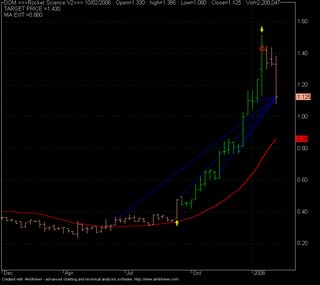

The results are shown in the chart posted.

Performance for profit was improved when the systems were traded together, and drawdown was better than just trading the most profitable single system. More trading opportunities provided greater profits but did not increase drawdown in proportion to the profits.