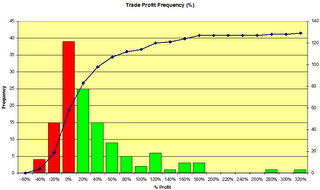

% Profit frequency chart for 129 trades to compare with the dollar frequency chart below. On startup of the system I was a little cautious in terms of position size so the % profits were not matched by the dollar profits!

Stevo

I trade longer term mechanical trading systems exclusively on the ASX. I rarely look at daily charts and the systems are built using weekly timeframes. The information in this site is based on actual trades in real portfolios. I don't trade using margin or any sort of leverage. I mainly use Amibroker for system testing and trade monitoring. I am not selling anything. This is just a journal to record where I have been and, just maybe, where I am going.