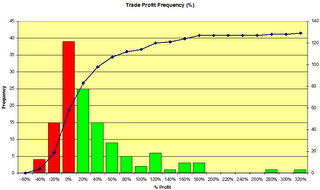

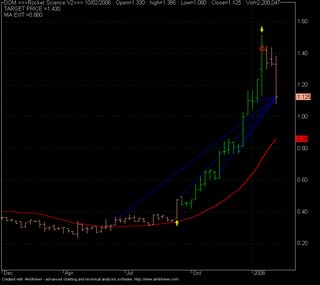

Below I posted early 2006 results. I revised the charts above give a better picture. The last bar shows carried forward open trades. Even though 2006 could be considered down on previous years in terms of realised profits the open profits carried forward into 2007 gives a better idea of how good 2006 was. Profit factor is still over 3 at 3.34, including open trades.

Over the last year there has been quite a distinct accumulation / distribution pattern of profit taking. So the 2nd quarter of 2006 realised substantial profits. Profits have been building through the 2nd half of 2006.

Don't ask me for % profits over the year. I added substantial capital late this year.

Let's see what 2007 brings.