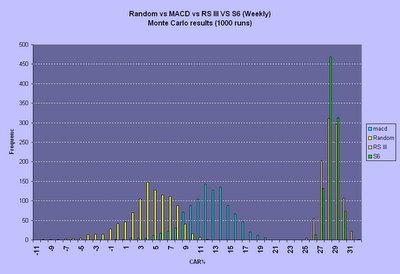

The chart shown compares 4 different systems using Monte Carlo analysis. 4 systems are compared - random buy and sell, weekly MACD and 2 of my own systems. The distributions show the possible range of outcomes for each system, as tested by a 1000 run Monte Carlo test.

Even random buying and selling would probably have made some money, although it's not guaranteed. MACD is also pretty average.

Different position sizing strategies have an impact on returns and I can boost returns considerably in a test run by changing position sizing strategies. I used a conservative $10,000 a trade on $100,000 for these tests, with a maximum of 11 positions.

Steve

No comments:

Post a Comment