On a recent harbour cruise I just caught "Wild Oats" in the lens. It was great to see this magnificent yatch feature on the front page of the Sydney Morning Herald the next day!

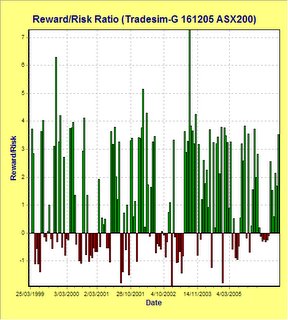

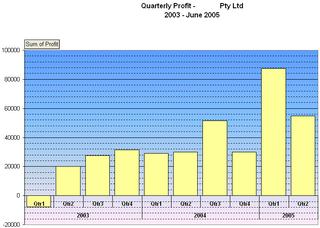

I trade longer term mechanical trading systems exclusively on the ASX. I rarely look at daily charts and the systems are built using weekly timeframes. The information in this site is based on actual trades in real portfolios. I don't trade using margin or any sort of leverage. I mainly use Amibroker for system testing and trade monitoring. I am not selling anything. This is just a journal to record where I have been and, just maybe, where I am going.