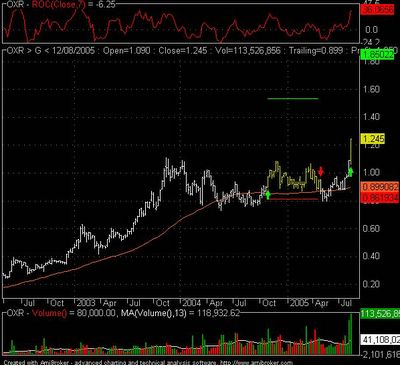

I have been doing a bit of work on my spreadsheet to analyse Monte Carlo runs in AmiBroker. The screenshot shows my Graphs page.

I just do a dummy optimise in AB dump the portfolio summary into Excel and everything else is pretty much automatic. This one has 500 iterations.

I'm off to Portugal on Wednesday and probably won't post anything here for at least 3 weeks.

regards

Steve